|

How These Charts Were Created

It is not necessary to have a background in computer programming to understand the

manner in which the statistical data for this study was prepared. In order for you

to more fully comprehend the results and the intensity of effort that was involved

in their production, you may wish to familiarize yourself with the methodology.

Here, in step form, is the basic procedure used in our computer analyses of the

Weekly Seasonal Charts:

- Read the daily history file for each market and month for every year on file, i.e.,

June Live Cattle ’67, ’68, ’69, ’70...’07.

- Line them all up by week using Friday as the end of the week.

- If there are 2 or fewer trading days by the first Friday of the month then regard

the week ending that Friday as being part of the previous month.

- Line up last X months of data to end of last pre-delivery month. If we’re

doing the August Live Cattle contract, for example, then stop at the end of July.

- The only exception to this is Sugar. Stop 2 months prior to the expiration

month for Sugar. So if the contract is for July Sugar then the last month of

the chart should be May.

- Normalize the data: Max = highest price; Min = lowest price. All other prices

X = (X – Min) / 100 * (Max – Min).

- Calculate the differences from week to week. Start with a closing price for

the first week. Say that it was 10. If at the end of the next week the

closing price is 11 then the week was a winning week and the gain was +1. Count

up all the winning weeks and all of the losing weeks. (Do not count weeks with

no change.) In the % square at the bottom of the table for each week show the

% winners or the % losers depending on whether there were more winners or losers. In

the square above the % squares show +/- depending on whether there were more winning

years or losing years.

- In the squares above the +/- squares show an arrow if the % value is greater than

60. Show a down arrow for <= -60 and an up arrow for >= +60.

- The trend line is actually the cumulative gain/loss values over all the weeks. If

the close at the end of the first week is 10 then the first plot on the chart is

10. If the gain for week 2 is +1 then the next point on the chart is 11. If

the gain for the next week is -3 then the next point on the line is +8, etc. Given

that the data is already normalized, the charts have a min value of 0 and a max

of 100.

There are other ways in which the data could have been analyzed. If you plan to

replicate this study with your own database, you may wish to experiment with different

techniques of aligning the data, or with different indexing methods.

These Charts Are Not Perfect

No price charts are 100% accurate. We have, however, validated the data, both in

real time and on computer, to test for accuracy. To the best of our knowledge the

data is reliable and reflects the true seasonal situation for each commodity.

Note that the weekly UP and DOWN percentages for

a given contract month are applicable only to that contract month. It is not advised,

for example, that you use the plot for November beans to trade July beans.

Before Using These Charts . . .

Before you use these charts it’s important to understand exactly what they

mean and what they are saying. It is for this reason that we urge you to read the

instructions and explanations provided below prior to using these charts. The main

caveat is that you understand what you’re looking at so that you will not

misuse it by reading too much meaning into this study.

By reading the instructions you can also save yourself a great deal of frustration

and confusion. The old saying “if all else fails, read the instructions”

comes to mind. In this case, read the instructions before all else fails.

How To Read The Seasonal Futures Charts

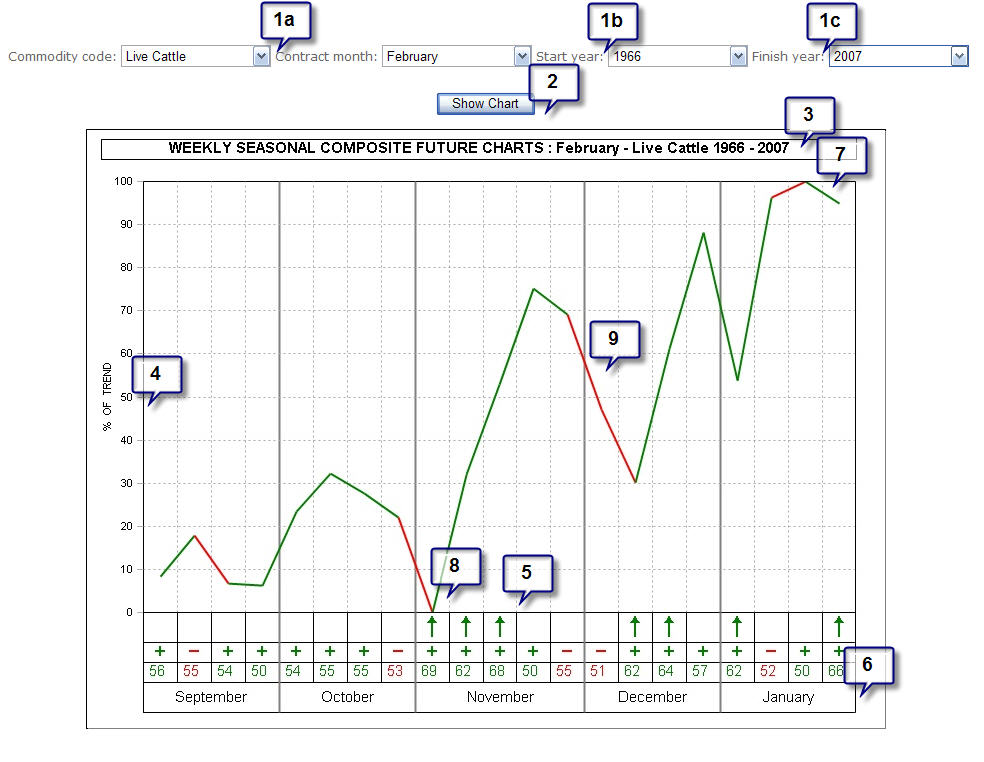

I’ve provided a sample chart here that indicates the

meaning of each chart item. Some specific uses will be discussed later on. Here

is a general overview of each chart.

PLEASE READ THESE INSTRUCTIONS CAREFULLY. It will save considerable time and frustration

if you read the instructions before attempting to use or understand these charts.

I have already discussed many of the key points. Refer to the sample chart on page

13 as you read these instructions.

- SETTINGS: To create a new chart specify choose

the parameters for the chart from the list below.

- Commodity code and Contract Month (note that this is slightly different for Spreads

and Stocks.

- Start Year: The first year of data that you want included in the chart (typically

the first year of available data).

- Finish Year: The last year of data that you want factored into the chart (typically

the most recent available year).

- SHOW CHART: Once you’ve chosen your parameters,

click on Show Chart to draw the chart.

- DESCRIPTION: This line lists the details on the

chart type including years covered and the contract, spread or stock which is plotted

below

- % OF TREND: This is the normalized rate of change

index that is used as a reference point. The scale values are not shown, since they

would be essentially meaningless inasmuch as they are of no specific value in using

the seasonal trends, other than to indicate average magnitude of change.

- PERCENTAGE OF YEARS UP/DOWN and ARROWS: These figures

show the WEEKLY percentage of time up or down on a percentage basis, for the specific

week number listed under the percentage reading. If the data plot (see #9) for a

given week is UP from the previous plot, and the reading is +75%, for example, then

this is an indication of upward seasonality. Percentage readings from +60%

to +100% indicate reliable bullish Seasonals and percentage readings from -60% to

-100% indicate reliable bearish Seasonals. Arrows up mark strong periods of bullish

seasonality and arrows down mark periods of bearish seasonality.

Note also the following conditions:

- PLOT IS DOWN and percentage reading is +60% or higher: This means

that the market tends to move UP during this approximate week more years than it

moves down; however, the usual down move is much larger than the net up move, thereby

accounting for the down plot. Upside potential during such weeks may be small in

terms of magnitude although upside moves can be large.

- IF PLOT IS DOWN and percentage reading is -60% or more negative:

This means that the market has moved DOWN 60% or more of the time for this approximate

week during the years examined, and that the size of the decline during down years,

is generally larger than the size of the rally during up years.

- PLOT IS UP and percentage reading is -60% or more negative: This

is an indication that even though most years are down for this approximate week,

during those years that were up, the moves were relatively large. If you sell short

on this type of combination, then you may take a very large risk for a potentially

small, but reliable profit.

- PLOT IS UNCHANGED (SIDEWAYS) from previous week: It is an indication

that the magnitude, or size of the move for this approximate week, is in equal balance

between up and down. This does not necessarily mean a sideways trend for the week.

Trend can only be determined by the accompanying percentage reading. If it is 60%

or more, then you can expect generally higher prices. If it is -60% or more negative

you can expect a down move. The sideways plot means only that the up and down moves

are about equal in size.

- MONTH AND WEEK: We use an ISO standard to determine

the number of weeks in a year and whether a month has 4 weeks or 5. The number

of weeks in any given month, using Friday as the last day of a week, will vary from

year to year. Sometimes November will have 5 Fridays, and other years it will have

4.

The weeks listed are reference points. As mentioned earlier, the last week in the

chart is the last week of the month prior to expiration (for futures contracts). From

this week we simply align all contracts and count “weeks back” from

this final week.

- AVERAGE SEASONAL HIGH is indicated by the highest

plot on the chart. This means that during the years under study, there has been

a tendency for prices to hit their contract high for the given period around this

week and/or month.

If a high is made during the last few weeks of a contract, then prices may move

even higher several months thereafter, and the next contract month should be checked

for this possibility.

If a seasonal high is associated with high readings in the percentage column, and

if a subsequent move to the downside occurs with equally reliable readings, then

this is most likely a highly reliable seasonal top.

- AVERAGE SEASONAL LOW: The same holds true for seasonal

low, only in reverse.

- PLOT: The major plot line shows the seasonal tendency

for all years included in the chart. The green and red sections indicate whether

the weekly price action tended to be positive (green) or negative (red) for the

given week.

Some Additional Details

You must remember that these charts are composites, or a combination of many years

of prices. As such, extreme highs and extreme lows during the same period of time

in different years tend to balance each other out. The net result will be a relatively

even line on the seasonal chart.

This is valuable information since it shows us that the market is not seasonal at

given times of the year. We can then reasonably assume that the existing trend will

be the single most reliable factor as opposed to seasonality. We can also assume

that once a trend starts it should continue. It is best not to rely on Seasonals

when this occurs.

Note also that relative highs and lows within the composite chart are not necessarily

repeated in any actual year’s market. Some years may look exactly like the

seasonal composite charts and others may not. A low may or may not occur at a given

time period. But this does not mean that the seasonal chart is not valid. In using

these charts there are several things you should look for.

- VERY STRONG UP OR DOWN WEEKS. By “very strong” we mean

reliabilities in excess of 70% over 10 years or more.

- DURING LONG TERM UP OR DOWN TRENDS Seasonals consistent with the

existing trend should perform well.

- SEASONAL HIGHS AND LOWS can be estimated by reference to the chart

and in accordance with the guidelines outlined previously.

- CONTRA-SEASONAL MOVES in the actual market can be spotted. If a

particular market shows highly reliable seasonality on the composite, and if this

pattern fails to appear in the actual market for any given year, then a further

move in the contra-seasonal direction can be expected. This is perhaps one of the

most important uses of a seasonal chart.

- MARKET TURNS can be expected at certain times of the year. If the

market is moving down, and the seasonal chart shows a very high percentage reliability

down move followed by a large up move reliability, then one should be on the lookout

for a trend change in the market.

There are many other uses of this information. Applications are limited perhaps

only by the imagination and resourcefulness of the trader. In general, it is best

used in conjunction with trading systems, technical or fundamental.

High Reliability Weekly Runs

Many of the seasonal composites show a several week span of high reliability percentage

readings. We call such periods “seasonal runs”. They are typically a

good period of time for high probability seasonal trends. An example of such a seasonal

run might be as follows: (weekly readings), 69%, 75%, 68%, 45%, 78%, 69%, 50%, 33%,

and 79%.

This is a very strong seasonal up trend which is interrupted only by a few low reliability

readings. The longer term trader might establish and hold a position through this

seasonal uptrend. Watch for these runs. They often pinpoint the most reliable seasonal

moves.

Seasonal price patterns are by no means the only reliable market cycles. At major

long term tops and bottoms seasonal cycles may be distorted. If you are aware of

the long cyclical term patterns within which Seasonals function, you can be prepared

well in advance for a period of time during which Seasonals may become unreliable.

You must remember, above all, that when one extracts a part from the whole, an unnatural

distortion of the original data may result. Consequently, when the analysis is over,

and we have gleaned the necessary information, the part must be replaced within

the whole.

A total picture is necessary in the formulation of any long-range decision. A student

of Seasonals should also strive to be a student of cycles.

Limit Your Losses Regardless Of What The Seasonals Say!

One of the worst errors a trader can make is to become totally dependent upon a

method or technique. We do not, as yet, have seasonal trading tools that are totally

reliable. I urge you to use good sense when making trades. Use stop losses; limit

risk.

|